The relatively new accounting model for expected credit losses adopted by both IFRS and US GAAP in recent years creates a distortion in the financial statements of the acquirer upon execution of a business combination. The reason for this is that the acquirer is required to record a loss immediately in the full amount of the provision for expected credit losses in respect of the acquiree’s financial assets. The distortion becomes significant in a case where control is acquired over a subsidiary that has a large amount of financial assets that continue to be accounted for at amortized cost (such as loans granted, investments in bonds and trade receivables). The big (but not the only) problem that is particularly relevant at the present time relates to mergers and acquisitions in the banking area around the world. The solution must be accomplished through a revision of the existing accounting standards.

The dramatic change in the accounting model relating to provisions for credit losses made in recent years in both of the leading accounting frameworks (ECL in IFRS and CECL in US GAAP) is presently causing a distortion in certain business combinations, which is usually quite significant when acquisition of control over a financial entity is involved. The reason for this derives fundamentally from the accounting model that was ultimately adopted for treatment of expected credit losses – pursuant to which on origination of a loan, a provision for expected credit losses is recorded against an immediate loss in the statement of profit and loss. For purposes of illustration, if a company grants a loan of 100 and the relevant expected credit losses are 3, a loss of 3 will be recorded immediately, meaning that the loan will be measured pursuant to the amortized cost model at only 97. That is, the loan is recorded at less than its fair value of 100. This clearly constitutes a built‑in double counting in the new accounting model.

In general, from an accounting standpoint, a situation wherein on Day 1, without any economic event having occurred, a gain or loss is recognized immediately in profit and loss, is an accounting distortion that accounting principles must strive to prevent. This situation is plausible only in cases where there is no solution to the distortion – such as the relatively rare case of a gain on acquisition resulting from a “bargain” price (“negative goodwill”) in a business combination. Even in this case, before recognizing this unusual gain, the accounting standards themselves require the acquirer to carefully reexamine the matter in order to verify that all the identifiable assets acquired and liabilities assumed were identified and accurately measured – along with the other components that relate to the calculation of goodwill.

Back to credit losses, it is apparent that the optimal accounting model was exactly the one proposed at the outset whereby recognition of interest income over the life of the financial asset is to be made based on a risk‑free interest rate, while the interest differences will be recorded in a quasi “reserve” that will be reversed against realization of the credit risk in the future. Ultimately, this model was not adopted for various reasons and the concept underlying selection of the new accounting model of the provision for credit losses is that the distortion of immediate recording of a loss is not that significant. This is particularly true under IFRS, where the provision is recorded based on the forecast for the next 12 months, unless there has been a significant increase in credit risk. Indeed, where assets that are credit-impaired on initial recognition are involved, regarding which the above‑mentioned credit losses would most probably be significant right from the outset, both IFRS and US GAAP have a different accounting model whereby a loss is not recorded immediately but, rather, a downward adjustment of the effective interest rate is made. Moreover, practically, where a bank is involved that has a relatively stable loan portfolio, the double counting problem is not really felt from a results’ perspective, since it is more or less uniform over the years and causes a sort of “spread‑out” over time.

The problem is that the rationale that the distortion is not too significant from a practical standpoint is not applicable when a business combination is involved wherein control over a financial company is acquired. In such a case, the concept underpinning the accounting treatment pursuant to both sets of standards is viewing the business combination as an acquisition of the identified assets and liabilities of the acquiree based on their fair values on the acquisition date, where the difference between this amount and the consideration for the acquisition (obviously taking into account the rights of the holders of non‑controlling interests, if any) constitutes goodwill. That is, in a business combination the parent company is viewed as if on the acquisition date it acquired/granted the entire balance of the loans (or invested in bonds, and so on) of the new subsidiary based on its fair value, just like every other identified asset acquired. Consequently, in the first reporting period after the business combination an immediate loss will be recorded in the parent company’s consolidated financial statements in respect of the full amount of the provision for expected credit losses deriving from the financial assets of the subsidiary that will continue to be accounted for at amortized cost, such as loans granted, investments in bonds held to maturity or available for sale (where measurement of their results is based on the amortized cost method) – also in the essentially corresponding classifications of the last two items in IFRS (albeit under different names) – and trade receivables.

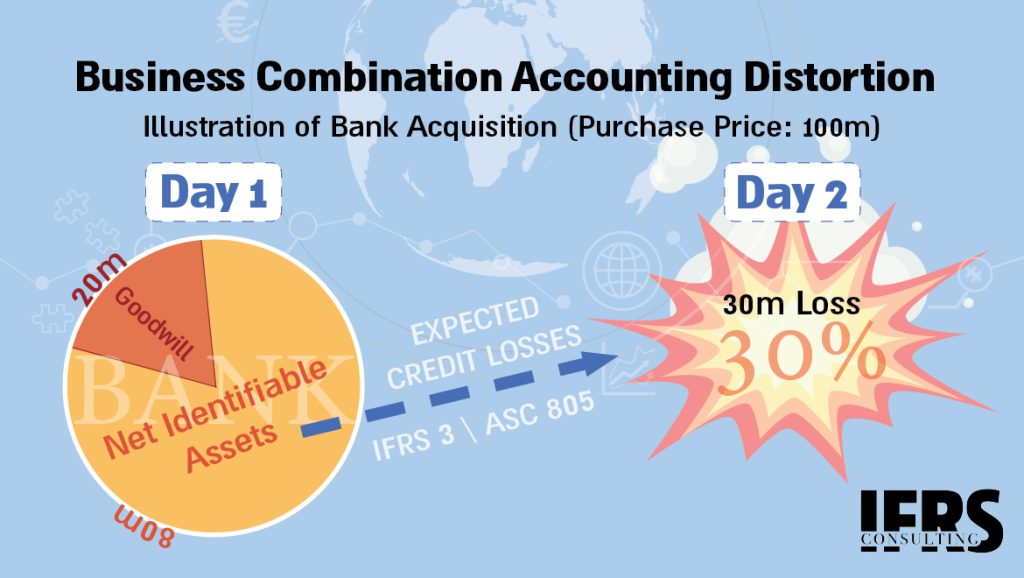

Illustration of the distortion

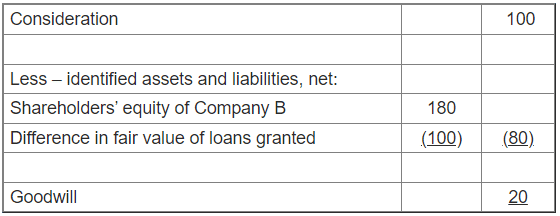

The enormous distortion can be illustrated by means of the following simple example. Assume that Company A acquires for a consideration of 100 million all of the shares of Company B, which is a bank (the shareholders’ equity of which is 180 million). The balance of the loans granted in the financial statements of Company B on the acquisition date (based on amortized cost) is 700 million after deduction of a provision for expected credit losses in the amount of 30 million. The loans are not impaired. The fair value of the loans is only 600 million (in light of the increase in interest rate that has occurred since the loans were granted).

For the sake of simplicity, income taxes are ignored and it is assumed that there are no identified assets and liabilities that were not included in Company B’s statement of financial position, and there are no other differences as at the acquisition date between the fair value of the other identified assets and liabilities and their carrying amounts in Company B’s financial statements (for example, since the liabilities have short duration). In such a case, the loans granted will be measured on the acquisition date at their fair value (600) and the goodwill deriving from the acquisition will be calculated as follows (in millions):

Now, assume Company A continues the classification of the loans granted according to the amortized cost model (that is, it does not make a designation to fair value) and estimates the provision for expected credit losses also at 30 million. In this case, Company A will recognize on Day 2 a loss of 30 million – which is 30% of the acquisition cost of the bank! This loss will be recorded despite the fact that, as stated, Company A recorded the loans at fair value, which also reflects, among other things, the expected credit losses from the standpoint of market participants.

It is important to understand that, as noted, in any event the distortion already exists in the financial statements of Company B at the time of granting the loans. However, this is a continuing distortion that in a situation of a stable loan portfolio is not too alarming. As can be seen, the distortion becomes even greater upon the acquisition of Company B, since on that date the cumulative loss on all the loans granted but not yet repaid is essentially recorded all at once. It is important to stress that the distortion is larger under US GAAP since pursuant to the CECL model, the provision on Day 1 is made over the lifetime of the loan or other financial asset.

The problem exists mainly upon acquisition of a financial company. However, it could also occur, for example, upon acquisition of another type of company that has significant balances of bonds held to maturity or bonds available for sale, or that has a large balance of long‑term receivables. While it is true that the said distortion does not exist in a case of designation of the financial asset as at fair value through profit or loss, it must be borne in mind that where the acquirer is another financial entity, it usually is not able to “live with” the significant future fluctuations that are intrinsic to such a designation and, therefore, this is a somewhat less relevant accounting solution.

The proposed solution

A possible (and essential) solution to the above‑mentioned distortion, based on the assumption that the new model for credit losses will not be changed in the foreseeable future, is revision of the accounting standard covering business combinations, which is roughly the same under both IFRS (IFRS 3) and US GAAP (ASC 805). For this purpose, financial assets that are not credit-impaired on acquisition, which are measured at amortized cost, must be excluded from the regular principle of measurement at fair value (along with the presently existing list of exceptions from the above‑mentioned principle). Instead of this, a sort of “gross‑up” of the fair value should be made that is equal to the expected credit losses and, concurrently, a provision should be recorded on the acquisition date. Subsequently, the effective interest rate is to be computed based on the “grossed‑up” amount and, accordingly, it will necessarily be lower. Thus, without inflating goodwill, the distortion caused by recording the loss on Day 1 will be avoided.

To illustrate the proposed solution with reference to the above example, the loans granted will be recorded on the acquisition date at the amount of 630, which is their fair value on the acquisition date (600) plus the provision (30) and from this a provision of 30 will be deducted. The goodwill deriving from the acquisition will remain at 20. Consequently, for purposes of the subsequent treatment, the effective interest rate based on which income will be recorded, will be lower.

It is noted that this solution with respect to unimpaired debts, which is proposed solely for business combinations, is essentially the same as the existing solution at the level of the individual company regarding debts that are credit-impaired on initial recognition under both sets of accounting standards.

Not good for investors

The global standard-setting boards need to see to a relatively quick correction of the accounting distortion created. It is important to understand that a distortion of this type does not favor the investors in any way. It is reasonable to assume that the acquiring company will explain to the investors in the initial period that they need to eliminate and ignore the said one-off loss. However, this loss will lead to the acquiring company’s results in the upcoming years (over the remaining duration) having an upward bias, and it is likely that significant “efforts” will not be made to explain the situation to the investors. In this context, the situation is reminiscent of another distortion that existed under US GAAP (and was later corrected) regarding immediate recognition of a loss in a business combination relating to the fair value component of in-process R&D. The illogical result confused the investors and was ultimately favorable to the acquiring companies.

It cannot be ignored that in a case where the accounting rules are disconnected from the economic reality, there is potential for a real adverse impact on transactions, and in the present case on business combinations, which are an important business and economic engine. Presently, it would appear that the same distortion also exists upon the acquisition of an associate that is a financial company or is financial‑asset intensive, as stated, since the equity method of accounting is based mainly on the methodology of recognition and measurement of identified assets and liabilities in business combinations.

These days, the distortion has become even more pronounced in light of the fear of entry into a global recession and the resulting increase in the expected credit losses. The relevant problem at this time is for mergers and acquisitions in the global banking area (including in the cases of acquisition by UBS of Credit Suisse and acquisition of the credit portfolio of SVB). However, it also affects every other business combination wherein the acquired company has significant unimpaired debt assets.

(*) Written by Shlomi Shuv