Capitalization of specific borrowing costs incurred for acquiring non-qualifying assets by means of a capitalization mechanism that includes general borrowings leads to an upward‑bias in the recording of net profit and FFO, which could ultimately mislead investors. The distortion stems from the fact that general borrowing is not presently defined in such a manner that excludes specific borrowing that was taken out to finance non-qualifying assets. The distortion currently exists in both IFRS and US GAAP, although in the last few years it is manifest in IFRS as a result of application of the new lease model. The solution lies in excluding specific borrowings taken out to finance non-qualifying assets.

This post usually addresses core accounting issues, such as business combinations and financial instruments, or new matters and trends on the business horizon that spark basic accounting issues, such as Crypto currencies. Nonetheless, occasionally it is opted to address marginal elements of the basic accounting principles that are part of less dramatic standards, but ones that could create significant distortions in reports to investors. One such item is the distortion posed by existing standards covering capitalization of borrowing costs – under both IFRS (IAS 23) and US GAAP (ASC 835‑20).

The most fundamental question with respect to capitalization of borrowing costs is to what extent this accounting treatment is correct from a theoretical perspective, particularly considering the lack of symmetry between a company that is financed mainly by loans and a company that is financed by shareholders’ equity. That is, the exact same asset is recorded at different values due to the financial leverage structure, resulting in future impacts on operating profit stemming from different depreciation expenses of the asset. This lack of symmetry derives from the fact that pursuant to generally accepted accounting principles, notional finance expenses are not recorded in respect of shareholders’ equity. In other words, the financing section in the financial statements will impact the operating section and will compromise the comparability between companies having similar operating activities but different financing structures.

For many years, the global position has been (and is not expected to change in the near future) in favor of the capitalization method for qualifying assets, which are generally assets under construction. For this purpose, capitalization is first made of the costs of specific borrowings taken out to finance the qualifying asset (if any), and thereafter, to the extent the qualifying asset was not fully financed by specific borrowings, capitalization is made of the costs of general borrowings that relate to the balance of the asset. The principal rationale is that this component constitutes part of the costs of bringing the asset to its designated use, and from a purely theoretical economic perspective – had the asset been acquired in a “ready‑for‑use” condition from the entity that constructed it, indeed part of its cost would have been traceable to the borrowing costs borne by such entity. That is, the purchaser would have been required to compensate the entity for, among other things, the normative borrowing costs incurred during the construction.

However, even given the existing accounting concept, there remains a distortion that needs to be resolved with reference to capitalization of specific borrowing costs incurred for acquiring non-qualifying assets. This distortion stems from the fact that general borrowings are not presently defined in such a manner that excludes specific borrowings taken out to finance assets that do not qualify for capitalization.

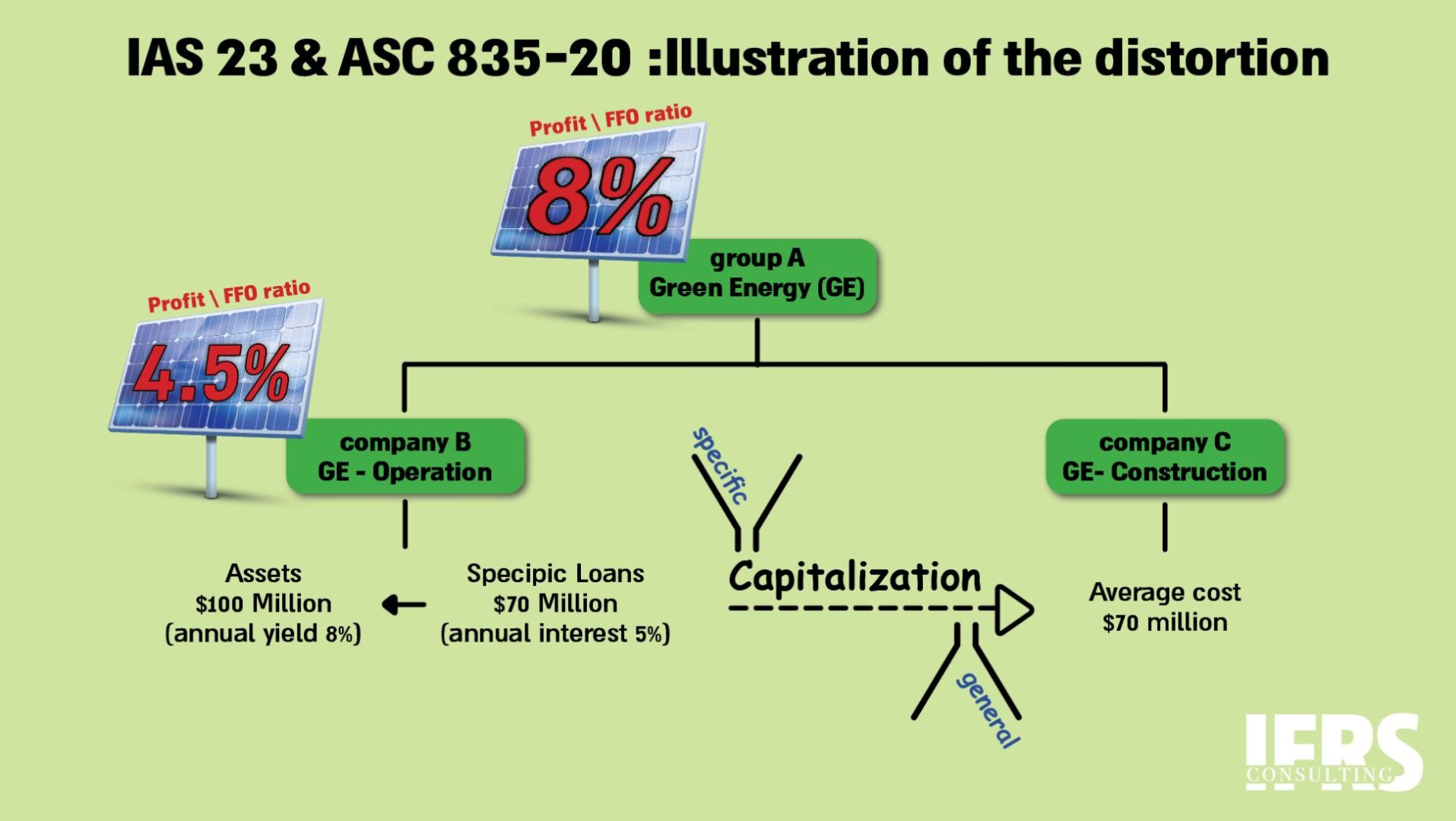

Illustration of the distortion

The above‑mentioned distortion can be illustrated by means of the following simple example (ignoring any tax effects): Green Energy Company A operates through two subsidiaries – Company B and Company C. Company B operates green energy facilities, the carrying amount of which is $100 million, and they are financed by long‑term bank loans with a specific lien per asset in the aggregate amount of $70 million (bearing annual interest of 5%). Those facilities generate an annual yield before finance expenses of 8%, such that the annual yield after finance expenses is 4.5% (= 8% – 70% x 5%). Company C is a developer financed by shareholders’ equity, that constructs energy facilities, the average cost of which in the period is $70 million. All the facilities (including those under construction) are accounted for in the financial statements of the companies as property, plant and equipment based on the cost model. Pursuant to the existing accounting standards, Company A will capitalize in its consolidated financial statements all of the borrowing costs in respect of the active facilities of Company B as part of the cost of the facilities of Company C under construction. As a result, Company A will present net profit and FFO that represent a yield of 8% in respect of the active facilities rather than only 4.5%, a situation which could clearly mislead investors.

Proposed solution: Illustration – What is the annual yield in respect of the active facilities represented by the net profit / FFO of the Energy Group?

| Under the existing standards | If the distortion is corrected |

| 8% | 4.5% |

For illustration purposes the example deals with two separate subsidiaries within a group. However, the exact same distortion exists where all the activities are performed by a single legal entity.

The counter argument is that money “has no smell” and apparently, indirectly, the money raised to purchase the active facilities, essentially finances, from the standpoint of the consolidated financial statements, the facilities under construction. However, practically it is obvious that the coherency of the basic accounting rationale for capitalization of borrowing costs, as stated above, is prejudiced. It must be understood that right from the outset capitalization of general borrowing creates a preference for the capitalization method in that it is attributed first to the assets under construction and not, for example, proportionally to all of the company’s assets. Therefore, inclusion of specific borrowings with respect to non‑qualifying assets in the general borrowings creates a distortion by attributing interest to the qualifying asset that stems from borrowing that was clearly not taken out for it.

Impact of the new lease model

It is noted that the problem referred to above became even more acute under IFRS when the new standard covering leases (IFRS 16) became effective, whereby right‑of‑use assets are recorded against financial liabilities and, quite naturally, this leads to many “specific” borrowings being added to the general borrowings. The position is untenable that leases create a borrowing that is used for financing qualifying assets that are not located on the leased asset itself. It should be pointed out that the expansion of this problem does not exist in US GAAP since the new lease model impacts only the statement of financial position and not the statement of profit or loss, such that no borrowing costs are “created” in respect of the leased assets.

An additional element that further underscores the problem is the amendment to IFRS that became effective about two years ago, whereby specific borrowing relating to an asset that was initially a qualifying asset but after completion of the construction no longer qualifies for capitalization, becomes part of the general borrowings that are capitalized as part of the cost of other qualifying assets.

The accounting distortion described above leads some companies, e.g., Energix Renewables in Israel, to totally ignore capitalization of general borrowings when the chief operating decision maker reviews the operating results to make decisions regarding resource allocation and performance assessment, as is evident by the note covering operating segments.

The present situation creates significant distortion in the manner of reporting the results to investors and could, in turn, be considered misleading. The solution lies in amending the relevant accounting standards and the definition of general borrowings to exclude specific borrowings taken out to finance other assets that do not qualify for capitalization. It is important to point out that the proposed solution should not create a significant practical implementation problem, since even the current accounting standards make a distinction between specific borrowings and general borrowings and a relatively clear line for application exists.

(*) Written by Shlomi Shuv