A new and very problematic (from an accounting standpoint) determination of the SEC, as part of SAB 121, will dramatically inflate the statements of financial position of companies holding and safeguarding the crypto assets belonging to users of their platforms. From now on, these companies will be required to recognize a liability in their statement of financial position that reflects their obligation to safeguard the crypto assets held for users of the platform. The liability will be recorded against a corresponding asset (which is essentially an indemnification asset) based on the fair value of the crypto assets held for users of the platform. As a result, Coinbase, the world’s largest public crypto exchange, is expected to increase its statement of financial position by $278 billion – an increase of 14 times compared with the statement of financial position as it currently stands! This enormous statement of financial position enlargement is expected to have consequences on the need to maintain a risk-based capital reserve and, as a result, limitation of the scope of the activities of these entities.

On the last day of March 2022, the SEC published Staff Accounting Bulletin (SAB) No. 121 regarding the accounting treatment in the financial statements of companies holding and safeguarding crypto assets of the users of their platforms. The background for this publication is the rise in the number of entities providing various platform users the possibility of executing transactions in crypto assets. As part of the said service, the relevant entities will safeguard the crypto assets for the platform users and keep the key information required to access those assets (such as private keys to wallets in which the assets are held).

Pursuant to the SEC’s position, entities as stated are required to recognize a liability in the statement of financial position, which reflects their obligation to safeguard the crypto assets held for users of the platform. Upon initial recognition and on every reporting date this liability is to be measured at the fair value of the crypto assets the entity is obligated to hold for users of the platform. Concurrent with recognition of the liability, the said entities are required to record an asset (similar in nature to an indemnification asset in business combinations), which will also be measured upon initial recognition and on every reporting date at the fair value of the crypto assets held for users of the platform. It is noted that pursuant to the publication, an impairment loss is to be recorded with respect to the asset in case of events such as theft or cyber-attacks, such that this is not solely a case of statement of financial position inflation. A basic accounting analysis indicates that this decision of the SEC is not consistent with the conceptual framework definitions of an asset and a liability.

Pursuant to the SEC’s concept, the obligations deriving from these types of arrangements involve unique risks and uncertainties, such as technological, legal and regulatory risks, which could have a significant impact on the activities of the said entities and their financial position. Those risks do not exist in arrangements for safeguarding assets that are not crypto assets. At the foundation of the SEC’s accounting determination, is the fact that the ability of users of the platform of such entities to obtain future economic benefits from the crypto assets held for them depends on the activities performed by the entities for safeguarding the assets. In addition, the SEC’s concept is that the technological mechanisms relating to the issuance, holding or transfer of crypto assets, as well as the existing legal uncertainty regarding holdings of crypto assets for third parties, create significantly higher risks for those entities, including a higher risk of a financial loss.

Enormous scope of the impact

According to the description provided by the SEC, it appears that the type of companies that will be impacted by the publication is companies that provide a platform for trading in crypto assets (crypto exchanges), such as Coinbase, Robinhood and eToro. The assets of the customers held in these platforms are essentially held in custody. The customer transfers assets to a wallet address the platform provides him and thereafter he can view the assets in the personal section of the platform’s site/application. The private keys to the different wallets are held by the platform and the customers have no access to them.

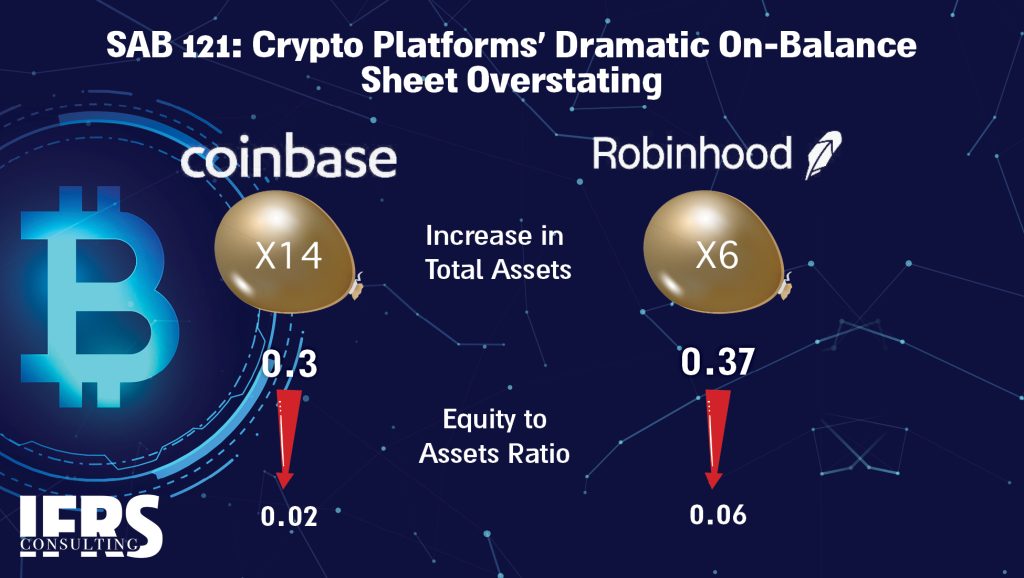

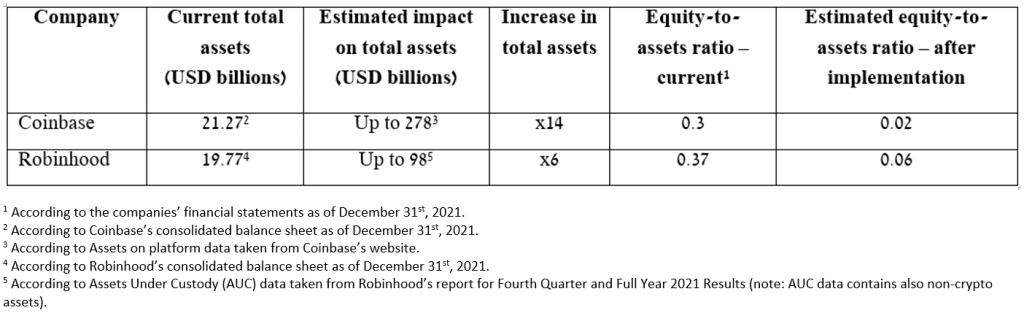

Application of this decision of the SEC will trigger a tremendous statement of financial position inflation for companies providing the above‑mentioned platforms. For example, in the case of Coinbase the new guidance is expected to lead to an increase of $278 billion in the amount of its total assets – an increase of 14 times compared with the statement of financial position as it currently stands! This enormous statement of financial position enlargement is expected to have consequences on the need to maintain a risk-based capital reserve and, as a result, limitation of the scope of the activities of these entities.

The expected scope of the enlargement of the statement of financial position as a result of application of SAB 121 in two notable public crypto platforms:

In addition to the public companies referred to above, which are subject to the SEC guidance, there are other private companies the statements of financial position of which are expected to be significantly impacted – should they decide to issue securities in the future in the United States. For example, eToro, which as noted operates a platform for trading in crypto assets, as well as in other assets such as shares, could increase its total assets by up to $10.7 billion[1].

It should be noted that this determination of the SEC seems to not affect companies whose crypto trading activity is based on CFDs (contracts for differences), without holding and safeguarding any crypto assets for its platform users. Those contracts are more like financial instruments than crypto assets (like CFD for gold or oil prices) and platforms that will use those contracts instead of holding and safeguarding the crypto asset itself for the platform users will not be required to recognize a liability and a corresponding asset. However, the platform users may have some commercial or psychological issues with such an instrument, as they will usually want to own the crypto asset itself and not some contract that imitates its yield. Furthermore, in this case, the customers’ deposits and withdrawals will be in fiat money (such as USD) and not in crypto, which may affect the transactions’ speed when a customer wants to withdraw his funds from the platform.

Furthermore, it appears that an analysis is required as to whether the publication is likely to also impact companies that provide only custody services. Such companies provide a platform to various entities for a secured transfer of crypto assets, such as Fireblocks and BitGo[2]. The statements of financial position of Fireblocks and BitGo could increase by $45 billion[3] and $64 billion[4], respectively. Customers of those companies have access to the relevant wallets, and for the most part execution of any transaction requires a two‑party approval – both by the company and by the customer. Pursuant to the agreement between the parties, the companies may not execute any transaction relating to the crypto assets without the approval of the customer. There are cases where customers have information regarding the private keys, this being for purposes of protecting the wallet in extreme cases wherein the company’s platform does not function properly.

When a regulator intervenes in the accounting aspect

The new guidance is clearly not consistent with the accounting treatment in the financial statements of brokers, which as is known do not recognize an asset and a liability in respect of securities held on behalf of their customers who use their trading platform. Imagine that a trustee would recognize in its financial statements assets of its customers that are held in trust for their benefit, solely based on the contention that the trustee could violate its duties and steal the said assets. It is important to emphasize that even the SEC does not dispute that the above‑mentioned companies have no right to use the crypto assets in their activities or allow third parties to use them. Therefore, they do not control the crypto assets. That is, there is no doubt that the users of the platform are those who control the assets, since they have the ability to direct the use thereof, and to obtain the economic benefits embedded therein. In addition, the crypto assets are not available to the platform’s creditors upon liquidation. Hence, there is considerable difficulty understanding the differentiation the SEC makes regarding the crypto area and its reasoning, since from the standpoint of pure accounting theory if one party controls an economic resource, it is not possible that another party will control that resource. Also, the attempt to cast the matter as a type of “other asset” – an indemnification asset, similar to that created in business combinations in order to represent the right to receive an actual cash indemnification from the seller to cover a liability created in the acquired business – is no less problematic.

Clearly, the matter at hand involves a brazen intervention of regulation in the realm of the accounting principles – particularly regarding the question of recognition of an enormous amount of assets and liabilities in the statement of financial position, where it would have been sufficient, for example, to provide disclosure in the notes to the financial statements. Solely for purposes of illustration, crypto platforms that apply IFRS and that are not subject to the SEC could, apparently, prepare the financial statements without the said increase, even after the publication of SAB 121. It should be noted that IFRS 9, which addresses recognition and measurement of financial instruments, is based on the principle of legal segregation, which can reasonably be assumed to exist in the regulated platforms, to determine whether cash that belongs to customers and that was received as collateral, constitutes an asset of the company. If it applies for cash, the most liquid asset possible and that has no “smell” at all, it should apply even more so for crypto assets.

Against the background of the aforesaid difficulties, it is also important to note that there is accounting rationale in recognizing a provision for risks borne by the crypto platforms – such as cyber risks or the risk stemming from theft of the key and other risks – similar to a warranty liability. Such a provision, which represents the possible situation as stated even according to the new publication, whereby there is an impairment of the new asset, while the liability would continue to be measured based on the full fair value, reflects a sort of consideration payable to the customer. Clearly, the question arises whether such a provision should be measured based on the expectation of loss events and theft of crypto assets or, alternatively, according to the relative fair value of the safeguarding services – in case it is deemed to be a performance obligation. In this context, the paradox, that in and of itself testifies to the large gap between the decision of the SEC and the prevailing reality, is that some of the relevant companies expressly state in their financial statements that due to practical considerations and reasons of materiality, they ignore the performance obligation of the safeguarding services.

The bottom line is that in the present case it is difficult to deny that the SEC acted more based on a “gut feeling” than in accordance with accounting principles. It seems that their action stems from a fear on the part of the regulator of the rapid development of the crypto area and the considerable uncertainty this entails. Even if the fear is justified, this is a frightening outcome that must serve as a reminder how wrong and inappropriate it is for a regulator to exploit its position in order to intervene in determination of accounting principles (and even to override them). Financial accounting standards boards exist in order to determine the applicable accounting standards and the Securities Authority’s vital function is solely to see to their enforcement – even if technically the law grants them greater authority.

(*) Written with Liran Shaulov, CPA, Controller at Celsius and Lecturer.

[1] According to Assets Under Administration data taken from eToro’s Q4 2021 Investor Update (note: Assets Under Administration data contains also non-crypto assets).

[2] BitGo is currently in the process of being acquired by Galaxy Digital Holdings, whose shares are traded on the Toronto Stock Exchange.

[3] Fireblocks’ assets under custody data that was reported in various articles.

[4] BitGo’s assets under custody data that was reported in various articles.