The case of SentinelOne regarding revision of the ARR information, which led to a collapse of its share price, illustrates the significant problem presently posed by reporting non‑accounting performance measures. Today’s individual investors in high‑tech companies rely on the said measures for share‑pricing purposes. While these measures are ostensibly objective, the manner of their calculation is not necessarily uniform or standard among different companies. The Securities Authorities must ensure the standardization of these measures for individual investors (sophisticated investors such as investment funds know and do this on a regular basis). In addition, presentation of a detailed reconciliation between the performance measure and an existing corresponding GAAP‑based accounting item is needed. At the same time, and with respect to the more commonly‑used performance measures (such as EBITDA), it is necessary to require companies that wish to present an adjusted measure to also present the standard measure.

At the beginning of the month, the Israel cyber company SentinelOne published its financial statements for the first quarter of 2023, along with notification of a change in the calculation methodology of the ARR measure and revision of historical inaccuracies in the recording thereof in the past. The retrospective revision of the ARR made by the company, together with a contraction of the annual forecasts, triggered a 35% drop in its share price! The SentinelOne case clearly demonstrates the problem latent in measures of this type that appear to investors to be objective. However, the manner of their calculation is not uniform and may not be comparable among companies. SentinelOne notes that the change in the manner of the calculation was made in light of a decline in the usage and consumption patterns of the company’s customers, and it relates to the manner of attribution of the usage‑based revenue previously included in the calculation of the ARR. The company retrospectively revised the ARR presented in its financial statements for the final quarter of 2022, and reduced it by $27 million, constituting 5% of the total amount. The ARR reported in each of the preceding quarters of 2022 was also reduced by 5%.

The ARR (Annual Recurring Revenue) measure is a very common measure among high‑tech companies, particularly companies using the SaaS (Software as a Service) model, the revenue of which is based on subscription fees. The measure is a leader among the above‑mentioned companies and it is intended to reflect the projected continuing revenue in the upcoming year from existing contracts. Beyond its being a managing tool, the ARR provides investors with an indication of the growth potential and the ability of the business to produce revenue in the future – which explains its importance. The ARR also comes under scrutiny due to the revenue‑recognition problem existing in SaaS companies, which derives from their business model. In these companies, although the payment is received in advance, in accordance with GAAP it is recognized as revenue over the period of the service. The outcome is that the accounting revenue relates to services previously provided, in contrast with the ARR that is “forward‑looking”.

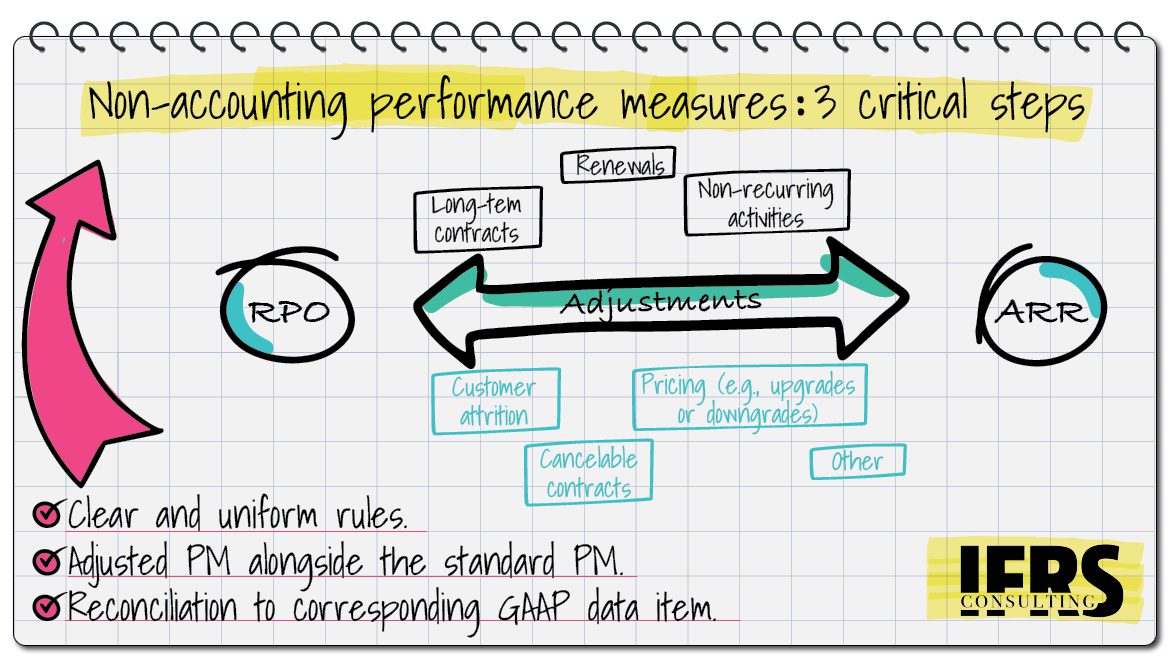

The theory underpinning the ARR measure would appear to be simple and its calculation basically involves multiplying the recurring revenue of the last month (MRR) by 12. Nonetheless, the calculation method may be different from company to company due to, among other things, the specific business model used and management’s assumptions. A critical point regarding the ARR is that its calculation is supposedly based solely on the expected “recurring” revenue. Nonetheless, determination of the “recurring” revenue is no trivial matter. In the specific case of SentinelOne, the said determination related to usage‑based revenue. However, from a broader perspective numerous additional complex questions arise regarding the matter. For example, whether and how the ARR calculation should reflect short‑term contracts and renewals, discounts granted to customers at the beginning of the period, cancellable contracts, upgrades and additions, customer attrition rates and other factors. Absent uniform rules for calculation of the ARR, the determination thereof is subject to management’s discretion and “creativity”, which in many cases is inclined to make use of lenient (favorable) assumptions.

The difference between non‑GAAP earnings and non‑accounting performance measures

There is no alternative but to recognize the fact that the financial statements do not provide all the financial information required by investors. Therefore, many companies in the capital markets turn to presenting non‑accounting performance measures outside of the financial statements as supplemental information, mainly in management (board of directors) reports, presentations for investors and various press releases. Along with measurement of the earnings pursuant to management’s conception and not in accordance with GAAP (i.e., non‑GAAP earnings), this information also includes various performance measures. These measures are not only reported externally to investors but are also usually used by the company’s management internally when evaluating and measuring the company’s performance, and occasionally they even constitute a basis for determination of remuneration. The performance measures addressed below also include measures such as EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), FFO (Funds From Operations, i.e. net income after eliminating revaluations and unusual income and expenses) and FCF (Free Cash Flows), which are encompassed by the definition of non‑GAAP measures (together with non‑GAAP earnings), since they essentially include adjustment of the GAAP information, and other non‑accounting measures (KPIs), such as ARR.

In this context, it is important to distinguish between non‑GAAP earnings that essentially represent the manner in which management believes the investors should view its representative earnings, and the performance measures noted. The non‑GAAP earnings measure is subjective in nature, wherein management adjusts the GAAP net income in order to eliminate “background noise”, which it views as not representing the company’s continuing business activities, such as elimination of impairment of assets, expenses relating to restructuring and expenses for share‑based payments. In order to underscore the substance of the information, it is sufficient to note that elimination of expenses in respect of a share‑based payment is very problematic, since it is untenable that a company will not include as part of its expenses a significant component of the remuneration of its employees! Nonetheless, it would surely seem that management has the right to express its opinion regarding the manner in which it believes the investors should view its results. Subjective information, have we already mentioned that?

On the other hand, the performance measures are usually derived from the sector in which the company operates and, occasionally, they include non‑financial data. Thus, for example, as was seen in the SentinelOne case, companies engaged in the SaaS spheres are in the practice of reporting ARR as a main performance measure. Additional widespread measures in the aforesaid companies include monthly recurring revenue (MRR), average revenue per user (ARPU), gross merchandise value (GMV), customer attrition rate (churn rate) and number of paying subscribers.

The particular problem with performance measures, which is more egregious than that of the non‑GAAP earnings, is that despite the fact that they appear in many cases to be objective and uniform, they are not all subject to a uniform framework of rules. Furthermore, similar to the non‑GAAP earnings, they are also not subject to audit by the auditors. The outcome is that the information involved is subject to management’s reporting interests and manipulations. Occasionally, this is manifest in far‑reaching assumptions used in their calculation. The result is information the quality and reliability of which is questionable and a lack of comparability between the performances of different companies – sometimes even within the companies themselves.

The accounting RPO loses to the non‑accounting ARR

The problem becomes more pronounced due to the addiction of the U.S. capital market to non‑accounting information and the tremendous importance the investors attach to this data, at the expense of the information included in the financial statements. To illustrate, it is not clear, for example, to what extent the investors are aware that the audited financial statements presently prepared in accordance with generally accepted accounting principles (both US GAAP and IFRS), include information regarding revenue expected to be recorded in future periods. The revenue recognition standards applicable to public companies require them to include disclosure in the notes to the financial statements of the amount attributable to performance obligations not yet satisfied as at the reporting date and the company’s expectation regarding the timing of the recognition of the said amount as revenue (subject to certain practical expedients). This data is referred to as RPO (remaining performance obligations). The RPO, similar to the ARR, also relates to future revenue from existing contracts (not necessarily in the succeeding year), and it includes the deferred revenue as at the end of the period, plus amounts not yet billed and that will be recognized as revenue in future periods. Indeed, the RPO and the ARR are different from each other, but the ARR still serves as the most prominent measure in the high‑tech sector, even though the RPO, which is derived from audited financial statements, is intrinsically of higher quality and more reliable.

In recent years, both the worldwide Securities Authorities and Accounting Standards Boards have attempted to cope with the non‑GAAP information. Thus, in the past two decades, efforts have been made by the SEC to advance a regulation regarding the matter of the non‑GAAP information, mainly in connection with transparency and consistency. In this regard, it is noted that the regulatory framework presently applicable to performance measures that are non‑GAAP measures by definition (such as EBITDA) is different and more restrictive than the framework applicable to other performance measures (such as ARR). For example, the rules applicable to non‑GAAP measures require, along with presentation of a non‑GAAP measure, presentation of the closest GAAP measure including reconciliation thereto; prohibit presentation of a non‑GAAP measure in a manner that is more prominent than the closest GAAP measure; prohibit making certain adjustments to the GAAP data, including adjustments that change the manner of recognition of revenue in accordance with GAAP (adjusted revenue); etc. These restrictions do not apply to other performance measures, such as ARR, that do not constitute non‑GAAP measures, and the regulation applicable to them involves mainly disclosure aspects. The importance attributed to the matter by the SEC and its enforcement measures are clearly reflected in the SEC’s correspondence in recent years with reporting companies, wherein the non‑GAAP matter is at the top of the list of the matters addressed in the SEC’s letters. As an illustration, in 2022 more than 40% of the SEC’s letters dealt with non‑GAAP information (while in comparison, only 11% of the letters dealt with recognition of revenue).

At the same time, in recent years we have witnessed a trend on the part of the worldwide accounting standards boards of bringing the non‑GAAP data into the financial statements themselves for the sake of relevancy. In this regard, the International Accounting Standards Board (IASB) is advancing a revolutionary project in connection with presentation of the financial statements and the information provided therein, whereby it is proposed to include non‑GAAP earnings in the financial statements based on management’s conception. In other words, the idea is to bring the non‑GAAP data into the GAAP data and, thus, as a natural consequence, to regulate it.

In addition, it is noted that already at the present time certain non‑GAAP data may enter into the financial statements, indirectly and subject to certain restrictions, by virtue of the accounting standards dealing with operating segments, which are based on management’s approach (pursuant to both US GAAP and IFRS). Regarding this matter, the U.S. Financial Accounting Standards Board (FASB) recently published a proposal to amend the U.S. accounting standard covering operating segments, such that contrary to the presently existing situation, public companies having a single reportable segment will be required to provide all the disclosures required by the Standard, which as noted could include non‑GAAP data. This requirement expands the horizon and increases the potential of bringing the non‑GAAP data into the financial statements, which automatically results in the regulation thereof. Bringing the non‑GAAP data into the financial statements themselves, which are subject to audit by the auditors, is an appropriate step that will lead to compliance with much higher standards of qualify, completeness and consistency compared with the presently existing situation. The above‑mentioned measure also has the potential of restoring the accounting rules and the financial statements to “center stage” of the capital markets, following an extended period of erosion of their status.

However, despite all of the developments noted, the SEC and other Securities Authorities (as well as the worldwide accounting standards institutions), generally do not require reporting of the main performance measures in the capital markets in accordance with uniform definitions. In the situation that has evolved, it appears that there is no choice but to act – that is, to determine clear and uniform rules, at least as a benchmark, for the manner of calculating main measures, including sectorial measures.

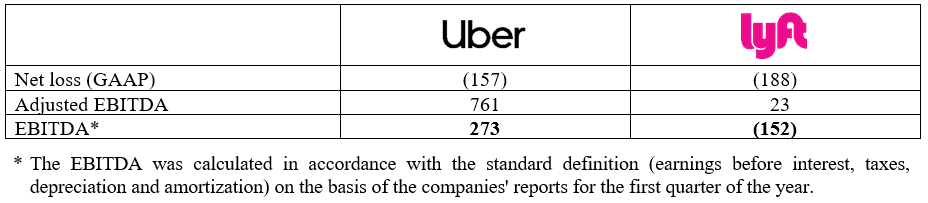

Uber presents: 13 adjustments to EBITDA

At the present time, the SEC permits deviating from the standard definitions of the performance measures, even though it recognizes their existence with respect to certain measures (e.g., EBITDA and FFO). In these cases, the expectation is that companies will clarify that adjusted measures are involved and will describe them as such. The problem is that in many cases there is an extreme deviation from the standard definition – so much so that the original measure loses its essence, but remains tied to the adjusted measure. A good example can be found in the reports of Uber, which reports adjusted EBITDA including 13 different adjustments! Beyond the difficulty this creates in understanding the company’s actual performance, the situation also makes it harder to compare its performance with other companies – this being without addressing the numerous problems involved with use of EBITDA as a performance measure. To illustrate, in the first quarter of the year, Uber reported an accounting loss of $157 million, alongside adjusted EBITDA of $761 million. If Uber had reported EBITDA based on its standard definition, the said amount would have been reduced by more than half. Lyft, a competitor of Uber, also reports adjusted EBITDA in a similar manner. Lyft reported an accounting loss in the first quarter of the year, in the amount of $188 million, and adjusted EBITDA of $23 million. If Lyft had reported EBITDA as defined, it would have remained with a loss of $152 million. Looking at the “big picture”, while the two companies reported an accounting loss on the one hand and a profit in adjusted EBITDA terms on the other hand, in standard EBITDA terms – which was not reported to the investors – Uber showed a profit while Lyft had a loss.

The disappearing EBITDA: Lyft shows a loss using the standard EBITDA (in millions of $)*

We believe that companies that choose to present a certain performance measure that is considered a main measure and is important in the eyes of the investors, should be required to present the standard measure (calculated in accordance with the provisions of the regulation). Further to that stated, if the company so wishes, it may also present alongside the standard measure a parallel data item based on its own particular calculation, along with explanations and reasons for the adjustments.

In this regard, it is noted that in 2011, the Israeli Securities Authority published a directive (which was recently updated), whereby rental property companies are required to present the FFO measure, a common profitability measure in the rental property sector, while prescribing the manner of its calculation. Along with the FFO calculated based on the Securities Authority’s approach, rental property companies in Israel customarily present an additional FFO measure calculated based on management’s approach. For example, particularly in the past year with the rise of inflation, the rental property companies in Israel are in the practice of eliminating in the adjusted FFO calculation, the inflationary impact on their financing expenses, contending that their future rents are also inflation‑linked and the matter is not yet reflected in the revenue.

An example of a company that already uses this calculation principle is Amazon, which apparently out of an understanding of the needs of investors, reports three levels of free cash flows (FCF). While the first level utilizes the standard definition of this measure – cash flows from operating activities less capital investments (CapEx), the other two levels include additional adjustments relating to finance transactions and lease transactions, and they provide investors with another perspective with respect to the company’s free cash flows.

Presentation of a reconciliation to GAAP

In addition to that stated above, we believe that if it is possible to connect between a performance measure and a corresponding accounting data item from the audited financial statements, it is necessary to require presentation of such a reconciliation, while furnishing detail of the reconciliation components. Such a requirement presently applies, in part, only regarding non‑GAAP measures, and we believe that it should be expanded to other performance measures as well. It appears that such a reconciliation could provide investors with important information and an additional indication regarding management’s assumptions and the reasonableness thereof. One example would be a reconciliation between the non‑accounting ARR performance measure and the accounting RPO included in the financial statements. If, for purposes of illustration, we revisit the SentinelOne case, the company reported ARR in its latest annual financial statements, in the amount of $549 million as at the end of the year (prior to the revision). Concurrently, the company reported RPO in the aggregate amount of $609 million as at the same date, of which $518 million is expected to be recorded as revenue in the succeeding two years. Assuming the revenue is spread uniformly over the period, the accounting revenue expected to be recorded in the upcoming year is $259 million – less than half of the ARR reported as at that date. It is possible that presentation of a reconciliation between the amounts would have provided investors with a more complete and clearer picture regarding the company’s future revenue from its existing customers, as well as management’s assumptions with respect thereto.

If so, the Securities Authorities should strive for standardization of the performance measures that are customarily used in capital markets (sophisticated investors such as investment funds know and do this on a regular basis), and should at the same time require every company wishing to present an adjusted measure to do so alongside presentation of the standard measure. In addition, where possible a detailed reconciliation should be required between the performance measure and a corresponding GAAP‑based data item. To a certain extent, this matter is similar to the present manner of presentation of the non‑GAAP earnings while reconciling it to the GAAP net income. This essential step will, on the one hand, give investors a basis for comparison while, on the other hand, will not prevent companies from presenting their “opinion” regarding the manner of the standard calculation.

3 critical steps for standardization

- Determination of clear and uniform rules with respect to the manner of calculation of the main performance measures in the capital markets, including sectorial measures.

- Where a company chooses to present an adjusted performance measure, such measure should be presented alongside the standard measure, while providing explanations and reasons.

- Expansion of the requirement to present a reconciliation between the performance measure and a corresponding GAAP‑based data item.

(*) This paper was co-authored by Shlomi Shuv and Matan Hagai, CPA, Director of Accounting – Wix, lecturer – RUNI