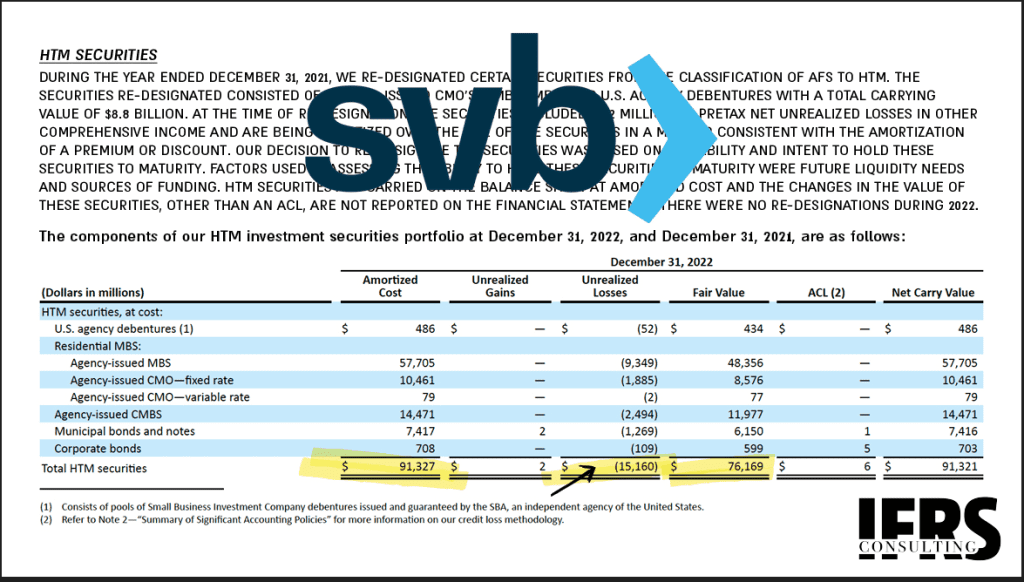

The accounting classification of investment in held to maturity securities whose fair value was only $76.2 billion, but they were measured at their amortized cost of $91.3 billion was not so trivial in light of the duration gap – the short duration of the bank’s liabilities compared to its assets. A potential mistake that could wipe out the bank’s shareholders’ equity which was $16.3 billion! This fact was not even identified as a critical decision in the bank’s financial statements.

It cannot be ignored that the rapid fall of SVB raises questions about its financial statements that were published only two weeks earlier. These financial statements presented business as usual and did not mention any doubt about the going concern assumption. An interesting figure from the aforementioned financial statements concerns investment in securities (mainly MBS with a very long duration) whose fair value at the end of 2022 was only $76.2 billion, but they were measured at their amortized cost of $91.3 billion – a gap of about $15 billion. To put that into perspective, that is almost all of the bank’s shareholders’ equity, which was $16.3 billion!

The investment in these long-term debt instruments was classified as held to maturity and was therefore measured at its amortized cost and not at fair value. The accounting classification of an investment in securities that are debt instruments held to maturity in financial entities that operate at high levels of leverage is by definition extremely sensitive, especially during periods of rising interest rates that lead to a decrease in the fair value of these investments.

From an accounting point of view, this classification should be reassessed at each reporting date to make sure that there is not only intention, but also ability, to hold those securities until their maturity without the need to pay off liabilities.

It should be understood that from a business point of view, against the background of the much longer duration of the assets compared with the duration of the liabilities, these securities are the “balancing figure” in the management of the bank.

The trigger for the bank’s collapse is indeed a liquidity problem, but this relates directly to the duration gap – the short duration of the bank’s liabilities compared to its assets against the background of the high level of built-in leverage. Note that the rapid collapse began with the realization of securities held for sale (which are actually measured at fair value, and the loss from the sale is “only” a reclassification adjustment of other comprehensive income without an overall effect on shareholders’ equity). In retrospect, of course, the accounting classification in this case was not correct, but this of course raises questions about the classification in real time, including the continuation of the classification in the latest published financial statements. The concern is that a problematic accounting classification assisted to conceal the grave failure in the risk management.

The bottom line is that the bank’s statement of financial position did not present the true picture and I assume that this is an issue that will be thoroughly examined in light of the circumstances that prevailed. Indeed, we should of course always be cautious of the wisdom of hindsight – especially when a run on the bank occurs. I’m sure I don’t know the whole picture, I’m just asking the questions and it could be relevant to other banks as well. By the way, from what I have seen, the issue of classifying these investments, a potential mistake which could wipe out the bank’s shareholders’ equity, was not even identified as a critical decision in the bank’s financial statements. This is a bit of a badge of shame for our profession…

(*) Written by Shlomi Shuv