The present accounting treatment of investments in Crypto and NFT assets does not capture the essence of the holding thereof for investment purposes and the significant volatility in value that is characteristic thereof. The said accounting treatment is presently perceived by investors, particularly those having industry understanding, as being very archaic – not to say even primitive. The entry of the NFTs, which has significantly simplified investment and trade in intangible assets, has given rise to the need for an accounting standard covering all investment assets. The time has come for the global financial standards boards – the IASB and the FASB – to publish a new accounting standard for investment assets, whereby all of the above‑mentioned assets will be measured at fair value through profit or loss, so long as it is possible to reliably measure their fair value. Such an accounting standard should also apply to similar items, such as gold and art works, which are held for investment purposes.

The fast and extensive development of the Crypto currencies and NFTs (non‑fungible tokens) underscores the existing problem in the accounting standards, namely, the absence of appropriate accounting guidance for recording of non‑financial assets that are held for speculative purposes or for a rise in value. Despite the fact that the blockchain technology revolution, in general, and entry of the Bitcoin, in particular, began more than a decade ago, the accounting standards boards have not yet found it compelling to make any adaptation of the accounting standards regarding the accounting treatment thereof. Pursuant to the presently prevailing conservative interpretation of the accounting standards in effect – both IFRS and U.S. GAAP – the dominant accounting classification of Crypto currencies is as an intangible asset, while the accounting classification of NFTs generally depends on the underlying asset. In any case, the classification is usually based on cost, and it completely fails to capture the substance of the investment therein. The increasing use of the aforesaid items, which has received a significant boost as a result of the Coronavirus, does not permit the global accounting standards boards to remain indifferent.

The starting point of this analysis should be that the accounting treatment of the Crypto currencies and certain types of NFTs as intangible assets is based on the assumption that they do not meet the definition of financial assets since, on the one hand, they do not include a right to receive cash in the future and, on the other hand, they are not equity instruments of another entity. Furthermore, the current concept is that digital currencies, including the Bitcoin, do not constitute “cash” since they do not represent a means of exchange and a currency unit for pricing goods and services. At least for now, the accounting standards boards do not view the Crypto currencies, in general, and the Bitcoin, in particular, as a means of exchange (i.e., that is used in exchange for goods or services). Irrespective of the conclusions in this article, it is certainly possible that at some point there will be room to challenge the present conservative and overly‑broad interpretation of the accounting standards boards (such as the IFRIC) if the official recognition of the Bitcoin by countries and/or its practical recognition as a means of exchange continue to strengthen – but it appears that this possibility is a long way off.

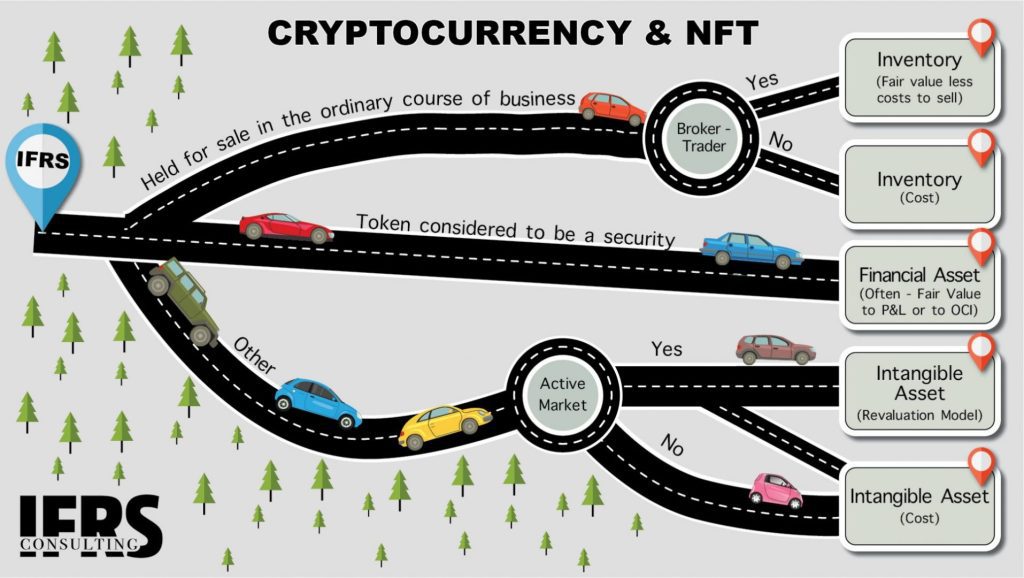

As a parenthetical, it is noted that to the extent the subject is tokens, with the characteristics of a security, they could convey to their holders a right to receive cash or residual value. These rights could be mandatory or, alternatively, subject to discretion, and they could also include voting rights. In cases where a contractual right to receive cash or another financial asset is involved, this would clearly constitute a financial asset. At the formal level, the token could convey an equity right, deriving from the governing articles of association – which is essentially a contractual right under the articles of association of the issuing company, similar to shares of a listed company, and therefore the definition of a financial instrument would appear to be met in respect thereof (even more so with respect to its underlying right). That is, the blockchain is only a means, however the right is tantamount to a publicly-traded share. Consequently, in most cases tokens considered to be securities meet the definition of financial assets – in some cases they constitute a debt instrument, while in certain other cases they could unquestionably be equity instruments. This determination does not appear to be inconsistent with the decision of the IFRIC relating specifically to Crypto currencies.

Accordingly, in light of the existing set of accounting standards, the main accounting treatment of the Crypto currencies and certain types of NFTs, assuming that the definition of a financial asset is not met, is as an intangible asset. An intangible asset is defined for accounting purposes as an identifiable non‑monetary asset without physical substance. Presumably, this definition is met, but the main point is that the treatment as an intangible asset does not actually reflect, in any relevant way, the holding of these assets – both due to the significant volatility in their value, as well as owing to the nature of the holding thereof. This is because the basis for the measurement of intangible assets under both IFRS and U.S. GAAP is cost. In this regard, it is pointed out that, generally, the useful life of these assets is indefinite and, therefore, systematic amortization is not recorded in the statement of profit or loss (subject to an impairment test performed annually, or whenever there is an indication that the intangible asset may be impaired).

It is noted that in situations where the above‑mentioned items constitute essentially inventory, under IFRS if relevant to the activities of the reporting entity, they are classified as inventory. To the extent broker-traders are involved, such inventory is measured under IFRS at fair value less costs to sell. The concept is that this inventory was acquired principally with the purpose of selling it in the near future and generating a profit from either price fluctuation or a broker-traders’ margin. Such a measurement can presently be observed, for example, in the financial statements of The Bitcoin Fund and of IG Group Holdings PLC.

In view of the increasing use of these assets, there is now a combination of factors, where standards that were not designed for this purpose are applied (in addition to the fact that there is always a lag in the update of accounting standards relating to intangible assets) together with a conservative interpretation of the existing standards, that prevents entry of these assets into the definition of financial assets – which would lead them in the direction of measurement at fair value through profit or loss and would thus better reflect their economic substance. Measuring these assets at cost would have to be considered a “primitive” accounting treatment, and the truth is no accounting standards board could have imagined their immense impact when drafting the existing accounting standards. Furthermore, the accounting standards developed over the years are more meaningful with respect to physical assets than they are for intangible assets.

In this regard, one comment is noteworthy relating to the differences between IFRS and U.S. GAAP, which appear to favor IFRS but which do not really change the picture sufficiently, namely with respect to the revaluation model – which exists in IFRS but not in U.S. GAAP. Pursuant to this model, if there is an active market for an intangible asset, it may be revalued through other comprehensive income. Where there is a decrease in value below cost, such impairment is recorded as a loss in the statement of profit or loss. Nonetheless, this is a very awkward, outdated and incoherent accounting model, which is also applicable to property, plant and equipment (without the requirement of the existence of an active market). The main problem derives from the lack of “recycling” to the statement of profit or loss, which makes it unattractive from a reporting perspective. The bottom line is that this accounting model does not really change the picture and the time has come for its complete replacement – with respect to both intangible assets and property, plant and equipment.

In the situation that has evolved, the solution requires a change of the existing accounting standards. The global accounting standards boards – the IASB and the FASB – need to publish a new standard that will call for measurement of the above‑mentioned assets that are held for investment purposes at fair value through profit or loss – so long as their fair values can be reliably measured. Such a standard should also apply to similar items, for example gold and art works, which are held for investment purposes. This accounting treatment concept is similar to the one presently existing in IFRS with respect to investment property, where the critical and important distinction between real estate that is held as property, plant and equipment or inventory, on the one hand, and investment property, on the other hand, has already been made in IAS 40 more than two decades ago. Regarding this matter, it appears that the said change will be easier to effect under IFRS since the basic concept already exists.

The inescapable conclusion is that there should be no difference between an investment in land, gold, a crypto currency, an NFT, a painting, a rare coin or a patent if it was made for investment purposes and an increase in value, rather than for internal use. The entry of the NFTs, which has significantly simplified the investment and trade in intangible assets, has given rise to the need for an accounting standard covering all investment assets. Measurement of the fair value is indeed a challenge, but in at least some of the cases, particularly in the case of the Bitcoin, there should be no measurement problem due to the existence of active markets. These markets could permit measurement of the fair value at least at Level 2, and in the case of the Bitcoin or gold, even at Level 1. In this context, the accounting standards boards could, in the first stage, restrict the use of fair value to Level 1 or Level 2 in the fair value hierarchy.

(*) Written by Shlomi Shuv